New CRE standards are coming!

After blogging about MISMO and CRE data standards for years, I can finally say the new rent roll standard is ready for public comment. Thanks in large part to the efforts by Fannie Mae, we will release the MISMO XML rent roll standard at the MBA’s annual convention starting Oct. 23 in Boston.

If you’re an owner, broker, lender, appraiser, investor, agency or other CRE participant, you need to pay attention.

The required documentation will include a PDF summary, an Excel file containing the Logical Data Dictionary (LDD), the XSD file and sample XML. After we included fields for Fannie Mae’s multifamily and affordable housing programs plus fields to accommodate senior housing properties, the standard ended up having 87 data elements.

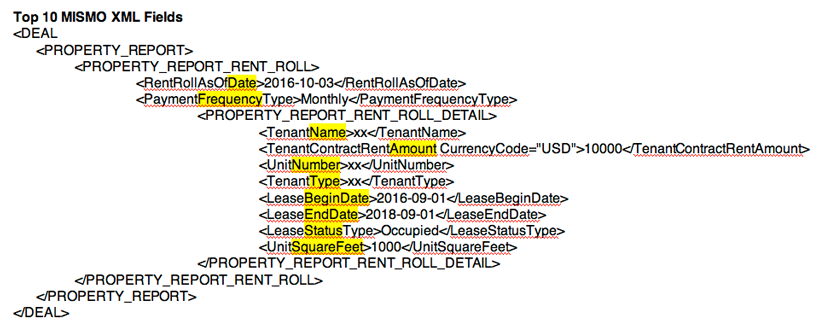

Here are the top 10 XML data elements:

What is MISMO?

The Mortgage Industry Standards Maintenance Organization (www.MISMO.org) was created by the Mortgage Bankers Association in 1999. MISMO develops, promotes and maintains standards for the real estate finance industry to enable consistent loan information to be exchanged efficiently and securely between mortgage lenders, investors, servicers, brokers, appraisers, analysts, agencies and others for the benefit of the industry.

MISMO standards have been widely adopted in the residential mortgage space, but they have not been accepted in the commercial and multifamily space. Having seen the benefit of standards on the residential side, about a year ago Fannie Mae committed resources and support for Commercial MISMO in general and for the rent roll standard in particular.

In addition to providing both technical and project management expertise to create the XSD and LDD files, Fannie Mae will encourage industry adoption which, as we saw on the residential side, should be the tipping point that brings widespread MISMO adoption to the commercial and multifamily space.

Why is this important to CRE finance professionals?

In order to value a commercial or multifamily investment from origination through ongoing asset management, a rent role is absolutely critical.

While the rent roll is the Holy Grail of CRE data, so far there has been no industry standard for the collection and reporting of commercial/multifamily rent‐roll data. This deficiency has made it challenging to accurately value and transact assets.

If you are an owner, broker, lender, appraiser, investor, agency or other CRE participant, you need to pay attention to this issue.

As industry standards take hold, electronic transfer of data will bring the “Internet effect” to commercial real estate. While few CRE players predict the same massive upheaval that hit the travel industry, we will certainly see better and less expensive software and data, as well as less friction and lower costs in deal transactions. As a result, we will see shifts in the ways properties are sold and leased, debt and equity are raised and owners pay brokers and advisors.

Ultimately everyone benefits from transparency in commercial and multifamily lending. But big change is coming, and the most successful people will adapt with the times.

CMBS.com will help you profit from the new standards

I am the chair of the MISMO working group that developed these standards.

The toolsets and marketplace we are making available at CMBS.com are compliant with the new standards effective immediately.

When you value, share and transact your deals on CMBS.com, we elevate your deals to the new transparency standards and make your operation more efficient and competitive. We empower you to not only survive the industry changes — but to profit from them.

— — —

Jim Flaherty is CEO of CMBS.com and the creator of the Backshop loan origination system. He is a trained credit professional with experience installing enterprise underwriting systems for commercial real estate lenders, rating agencies and investors.

Leave a Reply

Want to join the discussion?Feel free to contribute!