An overview of our software

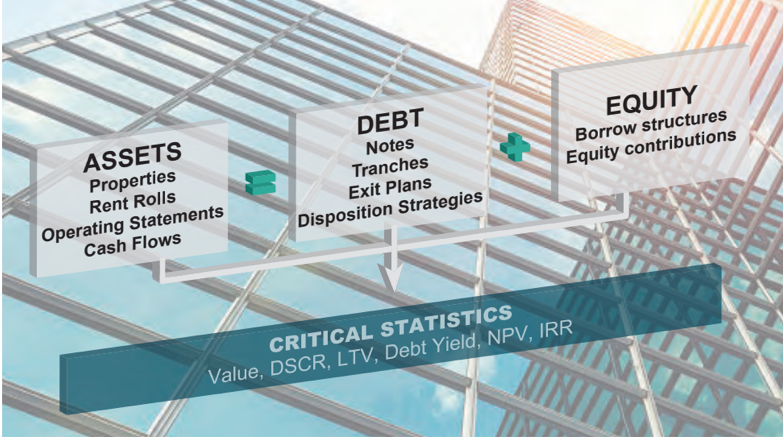

Deals are the foundation of CMBS.com software, as well as our parent Backshop. Deals are similar to a balance sheet where Assets = Debt + Equity.

- The Assets of a CRE Deal are called Properties.

- The Debt is called a Loan, which is made up of one or more Notes.

- The Equity is called the Borrower or Owner.

Deals are modeled in our software by:

- Conducting lease-by-lease underwritings of the Properties to calculate cash flow and value.

- The Notes, their payment terms and priority are modeled and, when compared to the cash flow/value of the Properties, critical statistics like Loan to Value (LTV), Debt Service Coverage Ratio (DSCR) and Debt Yield are derived.

- Finally, the Equity is modeled with both the borrower structure and the upfront and ongoing equity contributions to calculate the IRR of the Equity Investment.

Here is a simplified view of our data model: