Create stabilized (direct) cash flow

This page shows how to create a “commercial” stabilized cash flow. There are small variations based on property type, but these are the basic steps.

Set up your underwriting assumptions

There are slight variances based on property type. Here are the basic steps.

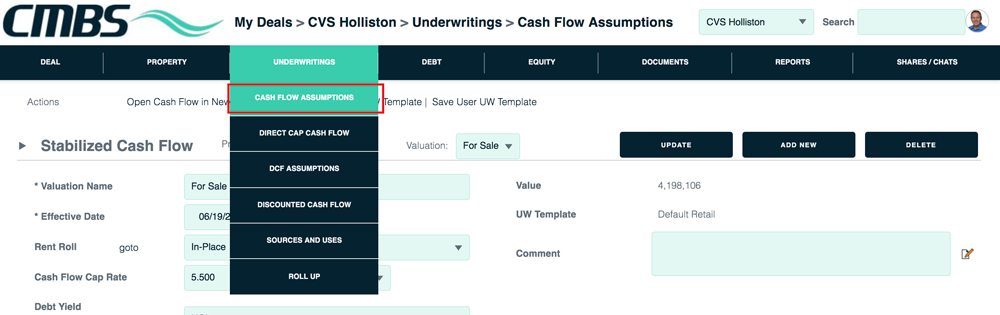

Go to Underwritings > Cash Flow Assumptions.

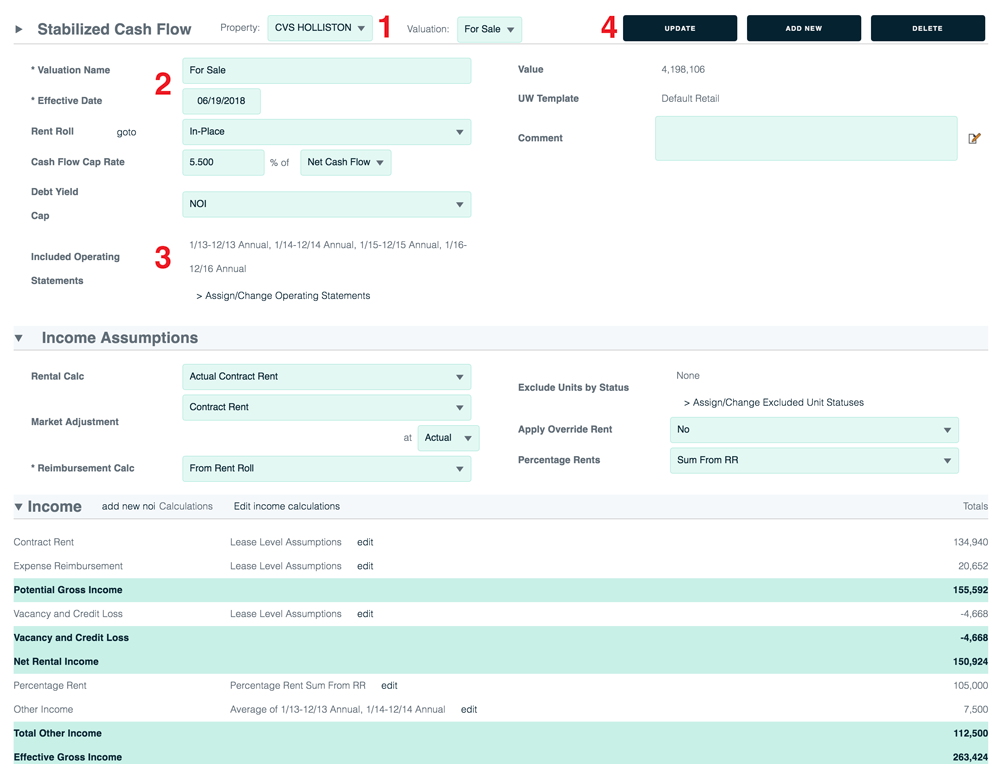

1. Verify that the correct property is selected.

2. Enter the required information (*). Enter as much additional information as you like. You can always return to this form.

3. Select the historical operating statements you want to include in your underwriting. Default is all.

4. Click the Update button to save your assumptions.

Verify income assumptions.

Rental Calc: Determines how the vacant space will be treated.

Market Adjustment: Determines the method of any mark-to-market adjustments.

Reimbursement Calc: “From Detail” pulls from the Expense Reimbursement data entered on the rent roll page. “From rent roll” pulls reimbursements based on the value entered for the tenant.

Exclude Units by Status: If excluded, tenants of the selected unit status will be treated as vacant space.

Apply Override Rent: Selecting Yes enables the ability to override contract rent on tenants in the Lease Level Assumptions section below.

Percentage Rents: Allows percentage rent to be calculated based on actual historical sales or per the amount entered on the tenant rent roll.

Verify expense assumptions.

Op Statement Assumption: The action (Average, Max, Min) and the inflation factor are used to calculate all expenses except management fee.

Management Fee: Calculated as a percent of EGI.

Verify capital assumptions.

TI and LC Rollover Approach: Either Straight Line (the normalized amount per the lease level assumptions) or Actual Approach (the actual roll per the entered term based on the lease level assumptions).

Rent to Use for LC: The lease value used to calculate the leasing commission due.

Enter lease level assumptions.

Type: Enter lease level assumptions that affect all tenants (Default), all tenants of a certain Unit Type (Unit Type), or by the individual tenant (Tenant).

When you are satisfied (at least for now), click Update.

Analysis and Tools

These sections display critical data such as tenant lists, details of the Actual Approach, details of the straight line approach and tenant-by-tenant details.

When you are satisfied (at least for now), click the Update button.

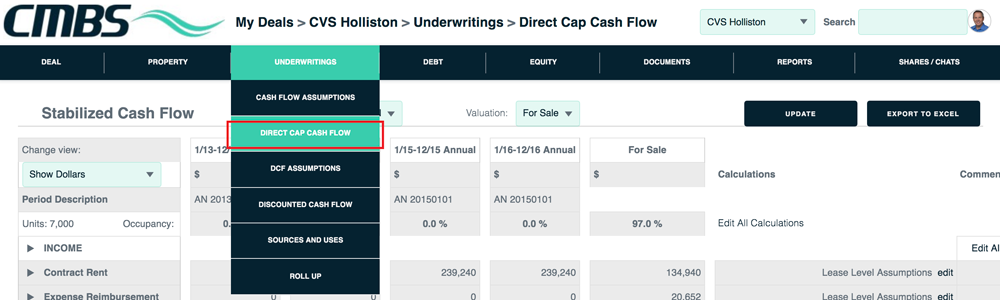

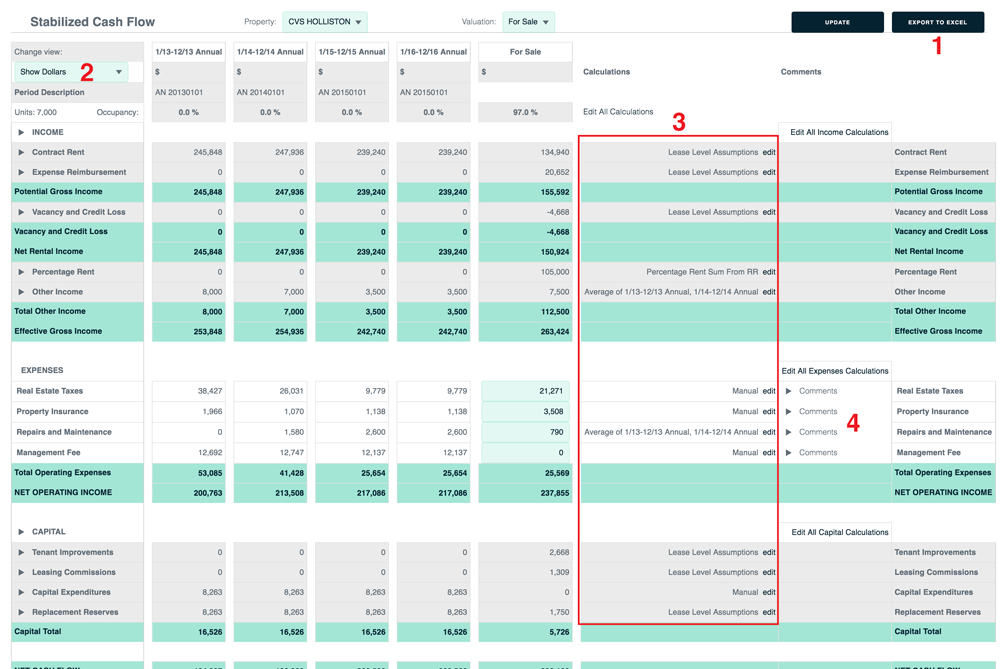

View stabilized cash flow

Go to Underwritings > Direct Cap Cash Flow.

Here is the stabilized cash flow. Notes:

1. The Export to Excel button gives you this cash flow in spreadsheet form.

2. Change View hides/shows the per unit and percent values.

3. Calculations being used for the stabilized cash flow are shown in the related rows. To override the default calculations, click the Edit links. For more information, see Edit Calculations below.

4. View, edit or add comments.

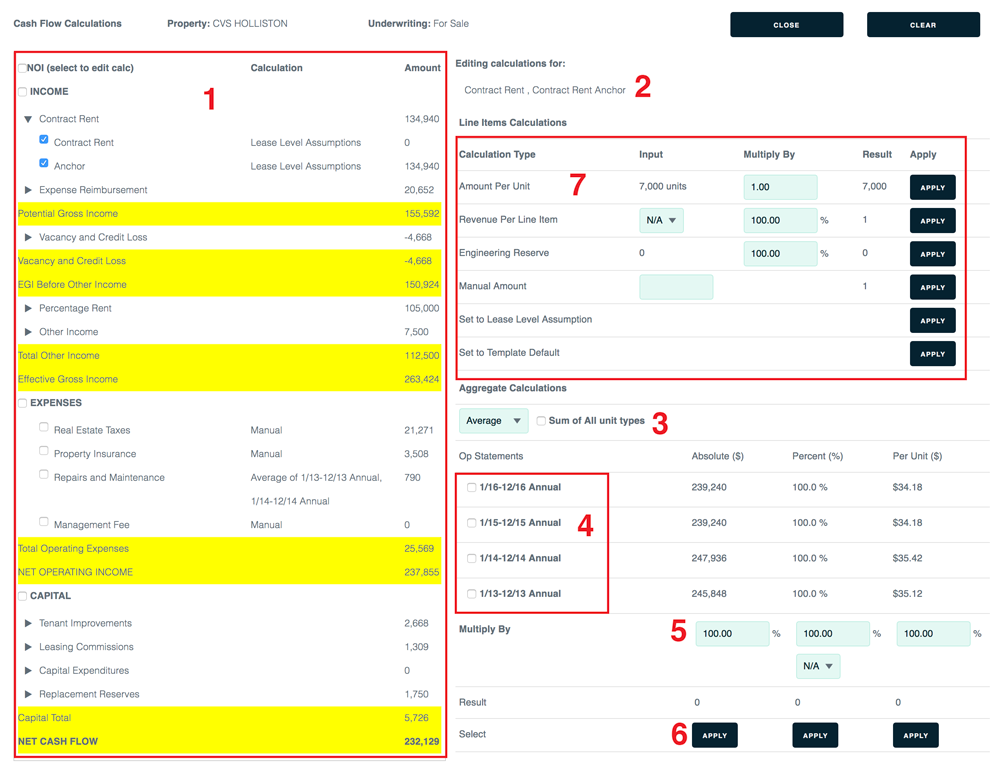

Edit calculations

To override the default stabilized cash flow calculations, click one of the Edit links.

1. Depending on which edit link you clicked on the stabilized cash flow page (above), all NOIs, a group of NOIs or an individual NOI will be checked.

Refine your selection by checking or un-checking the check boxes. Use the arrows to hide or expand categories.

2. The NOI categories you’re currently editing are displayed here.

Aggregate calculations

3. Specify type of aggregate calculation: average, maximum, minimum or sum.

4. Indicate the desired data sources. Verify the U/W assumption and choose one or more op statements.

5. Enter a multiplier in the absolute, percent and/or per unit column. The new result is calculated automatically.

6. Click the Apply button for the calculation you want to activate. Clicking the Apply button executes the calculation and overrides the assumptions page.

Line item calculations

7. Test ideas by changing inputs and multipliers. Clicking the Apply button executes the calculation and overrides the assumptions page.