Busy week: Checking in

It has been a busy week around here: ULI Conference, Leads Release, MISMO Progress, preparing for the Backshop User conference and listening to Julian Marley.

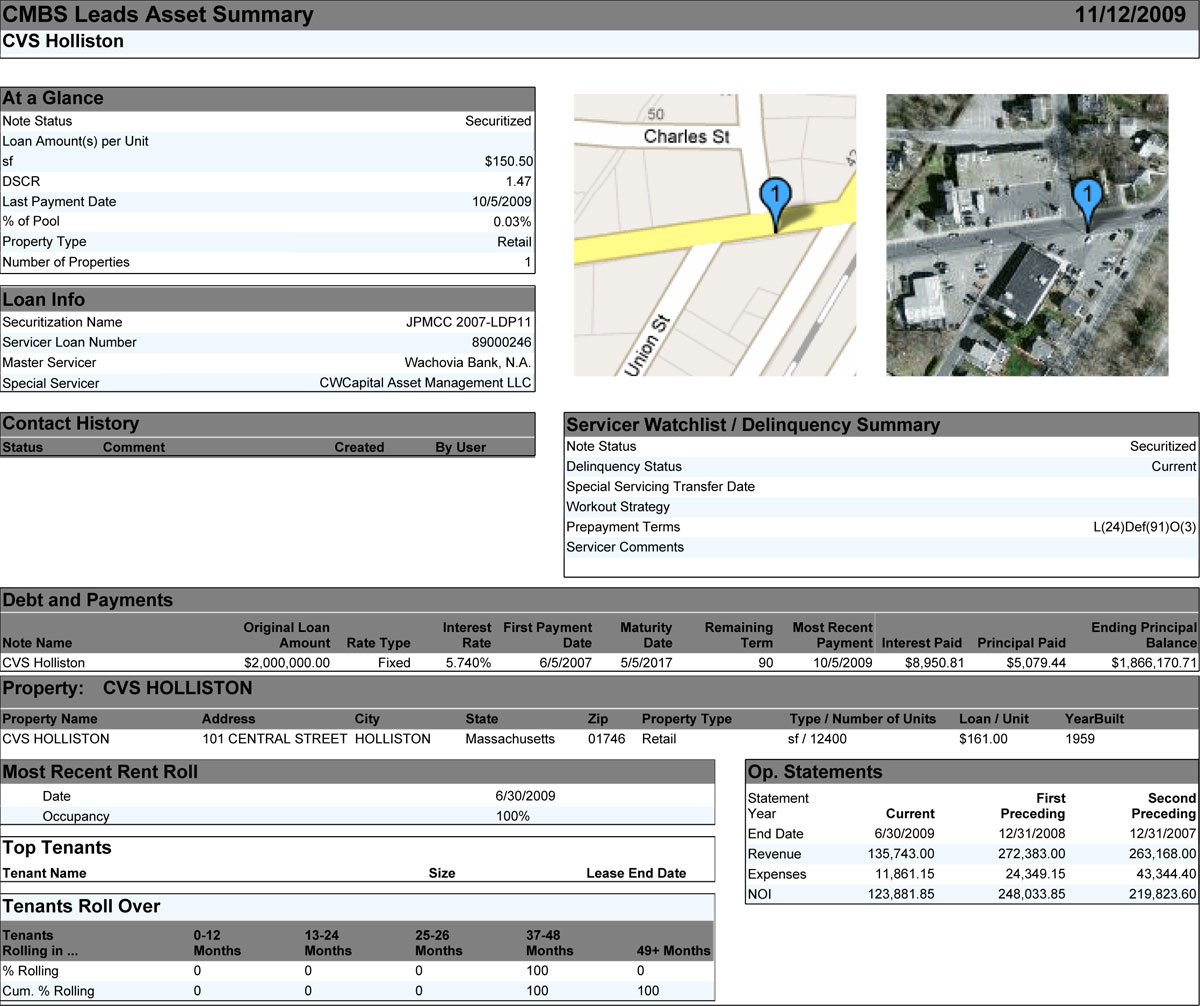

As an aside: The asset highlighted in the Asset Summary Report – CVS Holliston Mass. (PDF) is a property my brother and Dad own that has CMBS debt on it. It’s interesting seeing your own loan in the database. |

ULI Conference in San Francisco

Last week we had a booth at the Urban Land Institute Conference in San Francisco. The 5,500 registrants included a wide range of equity players including developers, REITS, funds, architects and city planners. There were not as many lenders as in the past, but attendance was strong and the exhibit hall sold out.

While the attendance numbers were good, the frozen debt markets, rising cap rates, and detiorating fundamentals were affecting most people. The bright spots were 1) the few REITs that have accessed the capital markets and 2) the funds with dry powder looking to buy into the downturn. I did some promoting for transparency but spent most of my time selling Backshop, Leads and our bond tools.

Leads Release

We upgraded the CMBS Leads product by adding a new PDF report at the asset level and adding expanded data to our download features.

Here are two sample reports:

CMBS Leads report – Alaska Hotels (Excel)

Asset Summary Report – CVS Holliston Mass. (PDF)

MISMO

The MISMO rent roll and operating statement committee, which I chair, had a call this week to go over the proposed XML schema we came up with at the end of August.

It took us a bit longer than we had hoped to get the structure integrated into the core data model, but we are moving again. We have another call set up for next week to finalize the schema, then it will be ready for its the 30-day public review period. Hopefully there will be a lot more on that in the coming weeks.

Backshop User Conference

Julian Marley rocks The Independent in San Francisco. |

We are having our annual user conference in New York this Friday. The last two years, we have hosted two-day conferences in San Francisco. This year, given the markets and travel budgets, we decided to have the meeting in New York instead. Our good friends at Bank of America are contributing the meeting space, and we have more than 10 clients coming in for a day of updates and priority setting.

We have traditionally had a music theme at the conference. The first year we went to see Willie Nelson at the Fillmore. Last year we saw Dark Star Orchestra at the Great American Music Hall. This year, we are going to the Metallica concert Saturday night at Madison Square Garden. We have a crew of 16 going and, as always, I am looking forward to a rocking night!

Speaking of rocking, I saw Julian Marley play last night at The Independent in San Francisco. Julian, a son of Bob Marley, is touring with his brother Stephen in support of Julian’s new album, “A Time and Place.”

It is an awesome album and a great show. If you see this show pop up in your city, consider going for great taste of some current reggae.

I’ll report in after the user conference and Metallica show with some cool pics/video.

— — —

Jim Flaherty is CEO of CMBS.com and the creator of the Backshop loan origination system. He is a trained credit professional with experience installing enterprise underwriting systems for commercial real estate lenders, rating agencies and investors.